If you run a subscription-based business, one of your biggest pain points probably is finding the best recurring payment system to automate your repeat payments.

After all, from getting your users to get on a subscription plan (instead of making a one-time purchase) and helping them personalize their schedule according to their consumption patterns to enabling them to pay via their preferred payment gateway, your payment solution does a lot of the heavy lifting in generating recurring revenue for you.

Not only that, your users interact with your recurring payment system every time they make a purchase or pay for their subscription (even when it’s automated). So it’s crucial from the customer experience aspect as well.

Also, the backend payment logistics need to work well.

It’s easy to feel overwhelmed when trying to find the best recurring payment system for your business’s unique billing needs. But to make your choice simpler, we’ve rounded up five of the top solutions from this crowded market in today’s post. In addition to our handpicked recommendations, we’ll also look at a few guidelines when finalizing one. But before we see all that, let’s look at the three types of solutions that help automate repeat payments.

Three common payment systems that support recurring payments

Here’s a quick look at the types of solutions a business can use to power its recurring billing.

1. Payment gateways

Payment gateways are software solutions that allow you to accept payments from your customers. Once users click the buy button, your payment gateway springs into action and takes the customer’s debit or credit card or net banking information and forwards it to a payment processing solution. It then communicates the transaction’s details back to your website. Some payment gateways like PayPal or Stripe let you set up recurring billing.

2. Merchant accounts

Merchant accounts are like intermediary accounts that hold the payments your customers make until a set settlement period is over. After this period, your balance is automatically transferred to your regular business bank accounts. Some merchant accounts like Braintree also come with recurring payments capabilities.

3. Subscription management solutions

Unlike payment gateways and merchant accounts, subscription software solutions help you bake more than just autopay capabilities into your billing. They help you deliver great subscription experiences to your consumers in line with their consumption behaviors. Subscription billing and management solutions (like Autoship) offer the most robust recurring billing capabilities and usually work on top of payment gateways and merchant accounts.

If your business needs flexible recurring billing capabilities or even some customizations, you need to go with a subscription management solution instead of the first two options. Here are a few factors when choosing one.

Upgrade to Autoship

When it comes to setting up subscriptions on your WooCommerce store, you need more than just some recurring billing software. You need a WooCommerce subscription solution designed to scale with your complex business. Take a moment now to find out if Autoship Cloud can really do what you need it to do.

Key pointers for choosing the best recurring payment system

Here are a few considerations to keep in mind when choosing a recurring payment system for your business:

Your industry

A B2B business’s recurring billing needs are different from those of an eCommerce business. And an eCommerce business’s recurring billing needs are different from those of an agency business. So start by listing what ideal recurring subscriptions look like for you. As a B2B business, you might not want to let your users automatically upgrade or downgrade their subscriptions. As an eCommerce business, on the other hand, you might want to let your users add more products to their scheduled deliveries or edit them as needed. Likewise, as an agency business, you might want to make customizable subscription service packages available. You get the drift.

Your goals

If you’re an online seller, you might want to convert your one-time buyers into subscribers along with boosting your upsell and cross-sell revenue. As an agency business or service provider, you might want to launch à la carte service packages that are subscribable to build predictable revenue. Whereas, as a B2B business, you might only be looking to bill recurringly using standard pricing models. So review the features of the options you consider and evaluate how they tie to your goals.

The overall logistics

On top of these, you need to evaluate logistics like how a solution you’re considering integrates with your existing tech stack (with your accounting software, CRM, or payment processor, for instance), how well it can handle the volume of transactions you process, how seamlessly it fits into your billing process, and the value for money it offers. At the granular level, you need to see if the options you’re considering support the debit cards you accept. Also, review the success rates of their credit card payments, among other things.

Let’s now look at the five best recurring payment systems that might be ideal for you.

Chargebee

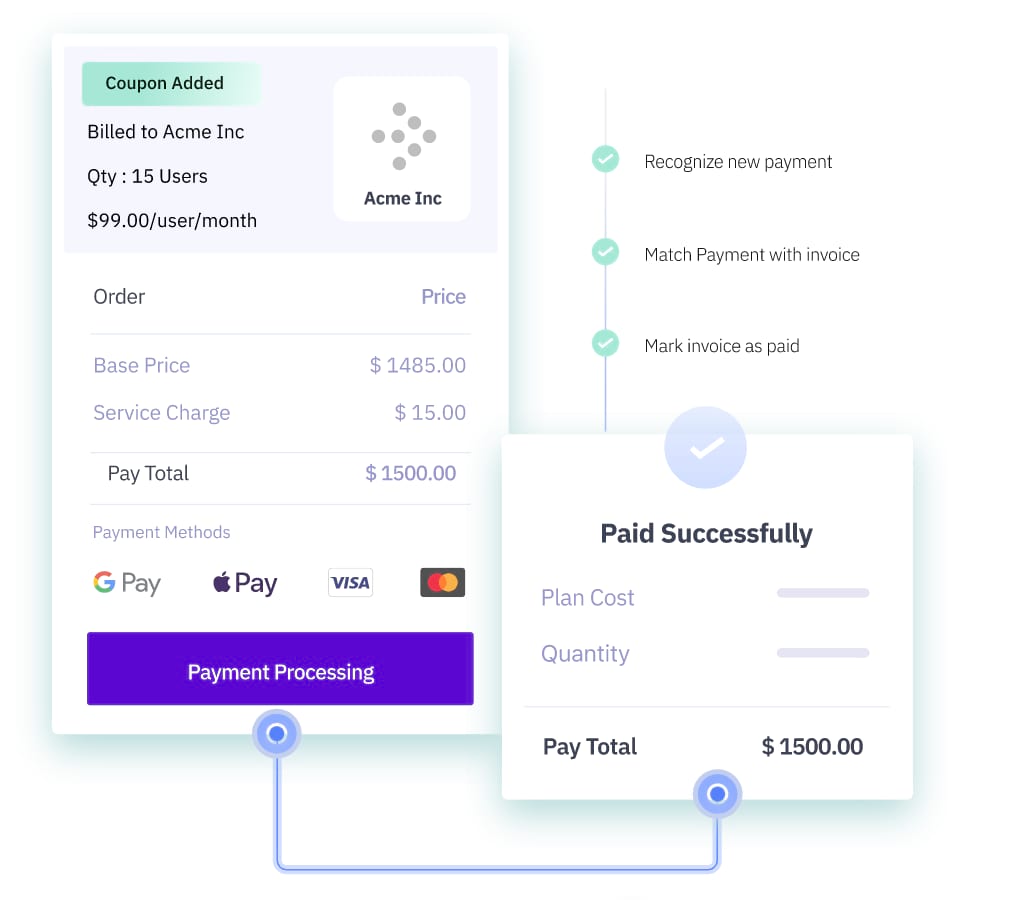

Chargebee is a complete subscription management system that brings together subscription management, billing automation, recurring payments, accounting, reporting, and analytics. More than 3000 businesses use Chargebee to power their revenue ops.

Chargebee: Pros and cons

Pros:

- Supports multiple payment methods, including cards, PayPal, Amazon Payments, Direct debit payments, Apple Pay, etc.

- Supports more than a dozen payment gateways.

- Comes with a mature coupon/discounting system that you can use to create regular and on-demand coupons.

- Offers segmentation capabilities to power personalized email communications over the entire subscription lifecycle.

- Offers localization with its support for multiple languages and currencies.

- Tends to be a complete subscription management solution that works on everything right from checkout to reconciliation.

- Offers capabilities to run marketing campaigns like pricing experiments, get a 360-degree view of a business’s financial health, and dig into the data to spot revenue opportunities.

Cons:

- Pricing feels steep for most startups, small businesses, especially when compared to alternatives like Stripe that offer a couple of its essential tools for free.

- The initial configuration is time-consuming; many users wish Chargebee offered better documentation.

- Accessing support, accelerating issues, and tracking them to closure is slower than most customers would like.

- Creating custom subscription options needs you to do some coding.

- Setting up one-time payments needs custom coding and could use better implementation.

- Editing existing pricing plans can feel challenging.

Chargebee is the best recurring payment system for enterprises and other large- and medium-sized businesses that mostly have simple recurring billing needs. You must be on Chargebee’s Scale or Enterprise plan as many of Chargebee’s essential features are only available on only its higher-tier plans. For example, if you want to offer your users multiple payment options, you must be on the Scale plan. Also, while the free plan looks lucrative, it offers almost no integrations.

Chargebee pricing

Chargebee offers a limited free plan. Its premium plans start at $299/mo (+ 0.6% of revenue over USD 50K), while its most popular plan is its $599/mo Scale plan that unlocks most of its features. This plan also charges 0.75% of the overage revenue.

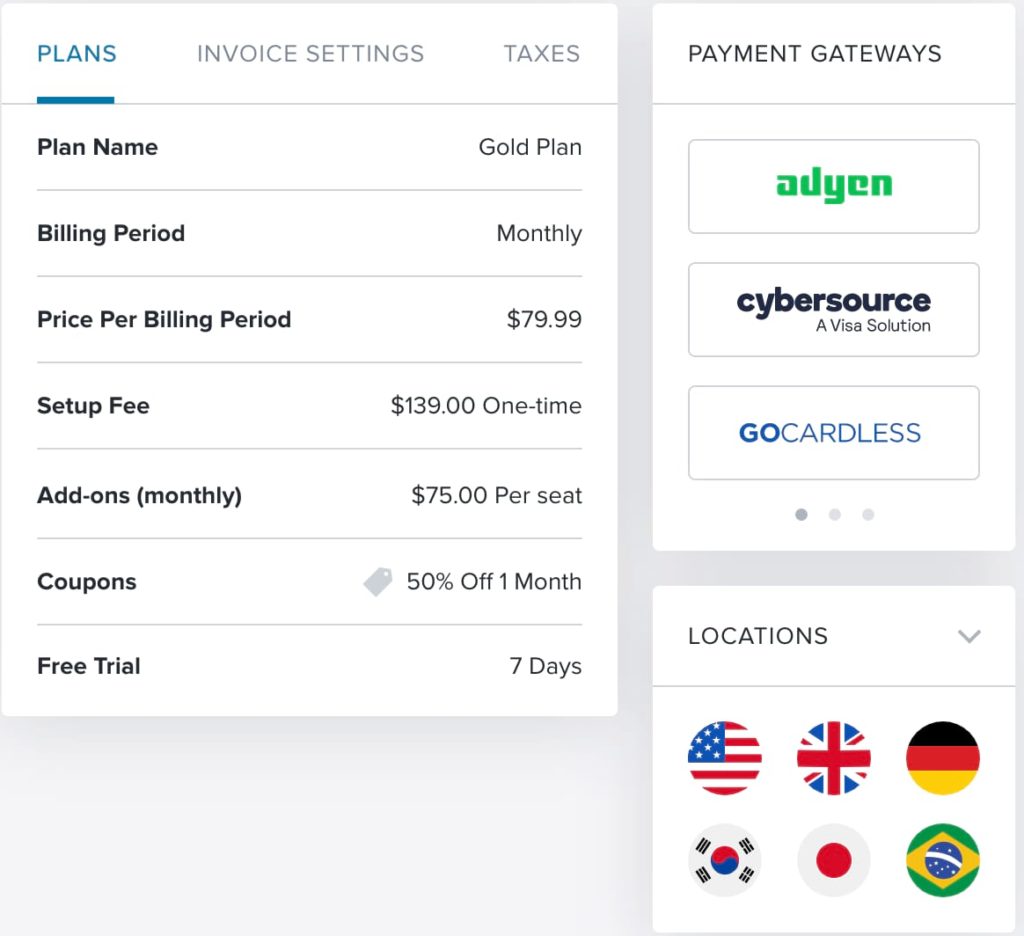

Recurly

Recurly is another well-rounded subscription management platform that brings recurring billing and payments, intelligent retention, and powerful analytics to your business. It’s one of Chargebee’s key competitors.

Recurly: Pros and cons

Pros:

- Supports fixed, hybrid, tiered, volume-based, stairstep, and usage-based billing models.

- Allows for easy modifications to existing subscription plans and launching new ones.

- Comes packed with tools for facilitating easy trials, discounted offers, and gift subscriptions.

- Turbocharges your payment strategy by letting you integrate with 21 payment gateways (including Stripe, Authorize.net, Braintree) and multiple payment methods (like Apple Pay, PayPal, etc.).

- Comes with a revenue optimization engine that includes features like account updater (which updates customers’ saved card information when there are any changes), expired card management, dunning management, intelligent retries, and decline management strategies to reduce churn.

- Supports 18 languages and 140 currencies and is a truly global subscription management and recurring billing solution.

Cons:

- Pricing could be a little more competitive; you have to pay a percentage of your MRR and so costs can grow as you grow.

- Recurly is a comprehensive subscription management platform with a demanding initial technical setup.

- The platform comes with a long learning curve.

- Although Recurly supports various billing models, customizing subscriptions isn’t easy.

- Setting up one-time purchases needs custom coding.

- Refund workflows aren’t optimized.

- Recurly could offer better reporting functionalities.

Recurly is the best recurring payment system for large-scale businesses that need enterprise-grade subscription management. It works well with many niches, including SaaS, retail, digital media and publishing, eLearning, and business and professional services. But if you’re only looking for a recurring billing system that you can set up within hours and start offering customized subscription experiences, Recurly isn’t for you. It’s a full-blown subscription management solution like Chargebee.

Recurly pricing

Recurly’s premium plans start at $149/mo (+0.9% of revenue). It looks like this plan pretty much only lets you collect payments. As it doesn’t offer integrations, most businesses will need at least Recurly’s Professional plan. (Contact sales for pricing).

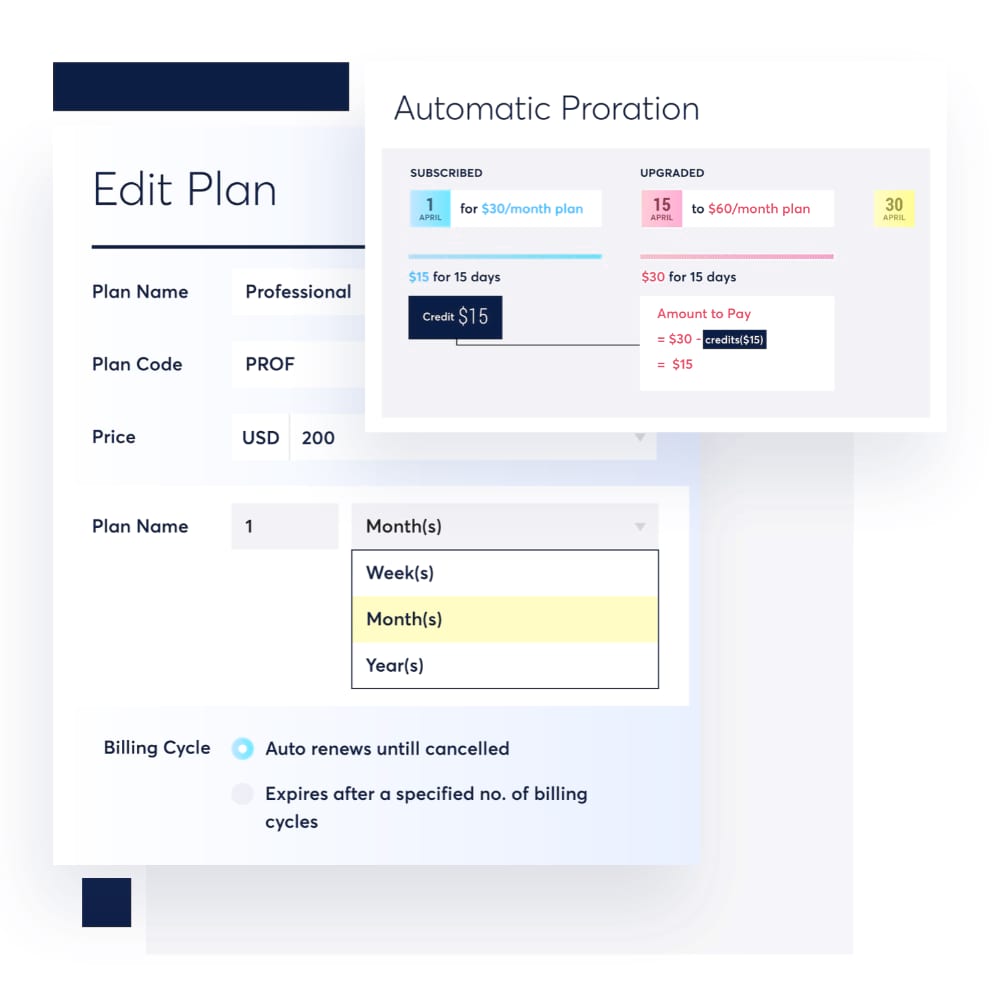

Zoho Subscriptions

Zoho Subscriptions is another focused subscription management solution that offers robust recurring billing capabilities. This solution makes deploying an automated billing system effortless and puts your subscriptions on autopilot within your budget.

Zoho Subscriptions: Pros and cons

Pros:

- Offers an intuitive platform that you can quickly deploy; you don’t need intensive training to get started.

- Offers both good value for money and quality support.

- Offers features like calendar billing, consolidated billing, and coupons in addition to regular automated billing.

- Supports end-to-end subscription lifecycle management with multiple email touches.

- Offers reporting features to help you dig into your business’s revenue data and find actionable insights.

- Offers APIs, webhooks, and zaps to help you build upon the solution.

- Comes with slick Android and iOS apps.

Cons:

- While the solution shines at setting up subscriptions quickly, it isn’t as customizable as the more mature subscription platforms like Chargebee.

- Setting up one-time payments represents a challenge, making offering one-off services is complex.

- Zoho’s automation and integration capabilities can feel limiting when used with apps outside of the Zoho ecosystem, like Quickbooks.

Zoho is the best recurring payment system for any business looking for hassle-free automated recurring billing cycles. While Zoho Subscriptions doesn’t compare with the likes of Chargebee or Recurly, it offers you everything you need to implement automated payments and is very cost-effective. Zoho Subscriptions is a natural choice for businesses already using the Zoho ecosystem.

Zoho’s pricing

Zoho’s premium plans start at $59/mo. This entry-level plan supports 500 subscriptions. However, if you’d like to use your domain name on the checkout or payment pages, you’d have to go with the $119/mo plan.

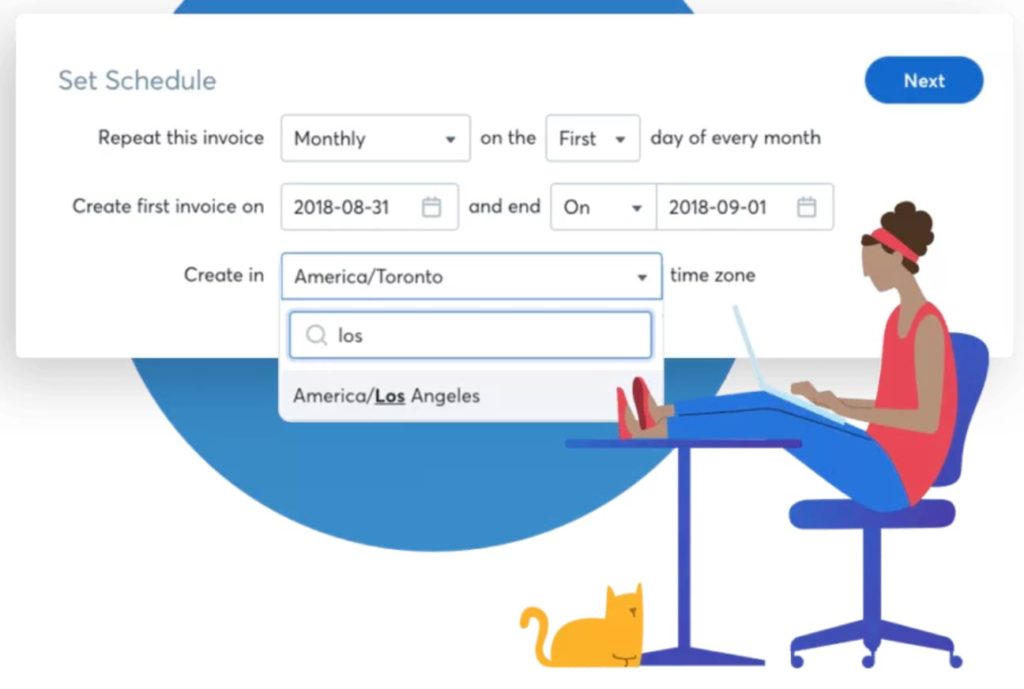

Bonus: Wave

If you’re looking for the best free recurring payment solution that takes care of almost all of your basic recurring billing scenarios (like setting up recurring invoices toward your monthly fees), go with Wave. Wave supports customized recurring invoicing and billing. Wave has its limitations, but it offers pretty much everything freelancers and small business owners need.

Autoship Cloud

Autoship Cloud, unlike the other recurring payment systems on this list, is a WordPress-first solution. If you use WooCommerce to sell physical products, Autoship Cloud is all you need to power recurring payments on your WordPress site. From setting up Amazon-like “Subscribe and Save” recurring payment subscriptions or something more customized to powering B2B recurring payment models for businesses fueling such B2C/D2C industries, Autoship covers a wide range of subscription-based payment scenarios.

Autoship Cloud: Pros and cons

Pros:

- Lets your customers truly own their subscription experiences. They can pause, stop, or resume their subscriptions as they like. They can even make edits (add or remove products) to their next scheduled delivery.

- Doubles up as a sales tool and skyrockets your upselling and cross-selling initiatives.

- Supports email communications over the entire subscriber lifecycle via Sendgrid.

- Lets you create (one-time or recurring) discounts to reward your most loyal users. You can target the users you want to offer the discounts to.

- Supports multiple payment gateways and methods.

- Allows integrations with your existing revenue tech stack via APIs, webhooks, and Zaps.

- Uses the powerful QPilot Scheduled Commerce Engine™ and is a complete subscription automation WordPress plugin.

Cons:

- While Autoship offers everything a B2C or B2B business needs for its repeat billing to sell physical goods as subscriptions, it isn’t a siloed payment solution like Chargebee. As a result, you might lack things like integrations with too many BI, OMS, or CRM systems.

- Qpilot’s Autoship caters to a wide range of B2B recurring billing scenarios as well, but it tends to be seen as a B2C solution (primarily for consumables with regular replenishment schedules).

- Being a WordPress plugin, Autoship Cloud only works with WordPress websites.

Autoship Cloud is the best recurring payment system for almost any business selling physical goods that wants to offer its users personalized and flexible (or fixed) subscription experiences. It’s an essential for B2C vendors selling consumables where consumers prefer to have control over their orders. B2B businesses, too, can use it to set up easy recurring payment plans to streamline the delivery of their supplies. It works well for small businesses and scales seamlessly for the medium and enterprise-level ones.

Autoship Cloud pricing

Autoship Cloud offers multiple plans starting at $49/mo. The $49/mo supports 50 scheduled orders (a month). Any orders over 50 are charged at $.50 per order. The growth plan unlocks more integrations and API access and costs $149/mo for 150 orders (with an additional $.25/order over this limit). Sign up for Autoship Cloud’s free trial.

Automated billing platforms aren’t just a key enabler for automating recurring online payments, but they have a direct bearing on your profitability too.

Three ways a recurring payment system can boost your profits

When used right, a recurring billing solution can significantly impact your business’s bottom line:

Positioning your subscriptions as an upsell

Subscriptions don’t only benefit businesses (by generating predictable revenue) but also improve user experience by helping customers own the delivery experience. A recurring billing solution like Autoship can actually convert your subscription plans into your competitive advantage.

Powering a coupon (or discount) marketing strategy

From offering value-based discounting for B2B businesses to enabling regular discounts for retail subscribers, coupons are one of the key growth hacks for any business. A good recurring billing software lets you create such marketing campaigns without writing any code.

Experimenting with different types of pricing

When it comes to pricing, experimentation can uncover your consumers’ preferred payment methods, subscription plans, and checkout experiences. An automated payments software like Autoship helps you launch new plans with just a few easy steps, so you can experiment with different variations and find out what works the best.

Wrapping it up…

To choose the best recurring payment system for your business, start by noting your requirements.

If you’re a SaaS business or sell membership-based programs, you probably only need straightforward fixed-fee recurring billing. However, if you sell consumables, you might want to offer your users a fully personalized subscription experience. Likewise, if you’re into services, you might want to upsell add-ons to your customers. A recurring payment system like Autoship supports all these use cases and more.

If you want to bring the best-in-class recurring billing capabilities natively to your WordPress (and WooCommerce) website, get Autoship. Sign up for Autoship’s free trial and see how it transforms your business’s subscription experience. Your customers will love it!

Upgrade to Autoship

When it comes to setting up subscriptions on your WooCommerce store, you need more than just some recurring billing software. You need a WooCommerce subscription solution designed to scale with your complex business. Take a moment now to find out if Autoship Cloud can really do what you need it to do.